Professional Solar Panel Installers

Make the Switch to Solar and Save Money — Greater Houston, Texas.

Hours

MondayClosed

Tuesday7:00am - 7:00pm

Wednesday7:00am - 7:00pm

Thursday7:00am - 7:00pm

Friday7:00am - 7:00pm

Saturday7:00am - 7:00pm

Sunday7:00am - 7:00pm

The Greater Houston area is one of the best areas in the country for homeowners to go solar. The large amount of sunshine we receive as well as low solar energy costs and property tax exemptions make it very attractive for homeowners to install solar for their homes.

The federal solar tax credit and other state incentives help you save thousands of dollars when you make the switch to solar for your home.

Our Reviews

Here are some 5 star reviews from our customers on Google.

Get a Custom Solar Quote

Our mission is to provide better solar experiences — that starts with making it easy for you to go solar.

Select your preferred meeting type below and we will get started on your quote.

Comprehensive

1 hour

On-site Meeting

Meet with your local solar consultant at the property to assess its solar potential, discuss your options, and get a custom quote.

Convenient

30 minute

Virtual Meeting

Join a virtual meeting with your local solar consultant and get a preliminary quote for your solar project.

Quick

15 minute

Discovery call

Book a 15-minute call to discuss your power bill, eligibility for tax incentives, and whether going solar makes sense for you.

Texas Solar Incentives and Tax Credits

Federal Solar Tax Credit

The Investment Tax Credit (ITC), also called the federal solar tax credit, helps you reduce the cost of your solar energy system. You can deduct 30% of the cost of your solar energy system from your federal income taxes. There is no cap on the value of your tax credit and it applies to both residential and commercial systems.

The federal solar tax credit was recently increased to 30% and its timeline has been extended. If you install a solar PV system between now and 2032 you will receive a 30% tax credit. If you installed your solar system in 2022, your tax credit has been increased from 26% to 30% and you can take advantage of the increased tax savings.

The federal solar tax credit helps Houston homeowners save thousands of dollars in upfront costs, in addition to many solar incentives and rebates for the state of Texas.

Net Metering in Texas

Net Metering is when your utility company monitors how much energy your home’s solar system produces and how much energy you consume. If your home’s solar system generates a surplus of energy, you will receive a credit from your utility company for that surplus energy.

There is no statewide net metering law in Texas, but many major utility companies will pay full retail price for your credits.

In the Houston area, you can find municipal utility companies or Retail Electric Providers (REP) like Green Mountain who will give you full retail credits for your surplus energy.

Texas Solar Rights Law

The state of Texas has a solar rights law which blocks Homeowners Associations (HOAs) from banning solar energy systems. HOAs in Texas can prohibit solar installations in extreme circumstances, but you as a homeowner will most likely not have issues with your HOA for when you decide to go solar.

Texas Property Tax Exemptions for Solar Homeowners

Long-term savings with solar energy will increase your home’s property value. A recent study from the National Renewable Energy Laboratory (NREL) found that your home’s value increases by $20 for every $1 you save on your electricity bills by installing solar panels.

For example, if your home’s solar energy system saves you $700 every year, your home’s value can increase by $14,000.

The good news for Houston residents is that your home’s increase in value from installing a solar energy system is fully exempt from 100% of the resulting property tax increase. The Texas state legislature has created a property tax exemption to encourage homeowners to install solar for their homes.

Texas Solar Rebates

Texas does not have a statewide solar rebate program, but many utility companies and local governments offer rebates and incentives for homeowners who go solar.

Solar rebates programs will vary, but they can lower the cost of purchasing a solar PV system in the state of Texas by 10-20%.

DSIRE Incentives Database - Texas

The Database of State Incentives for Renewables and Efficiency (DSIRE) is a comprehensive database that Houston residents can use to search for and find solar energy incentives in the Greater Houston area, the state of Texas, and across the entire country.

Our Locations

Jacksonville, Florida

Jacksonville, Florida Orlando, Florida

Orlando, Florida Treasure Coast & Palm Beaches, Florida

Treasure Coast & Palm Beaches, Florida Atlanta, Georgia

Atlanta, Georgia Central, Illinois

Central, Illinois Southern, Illinois

Southern, Illinois Kansas City, Kansas

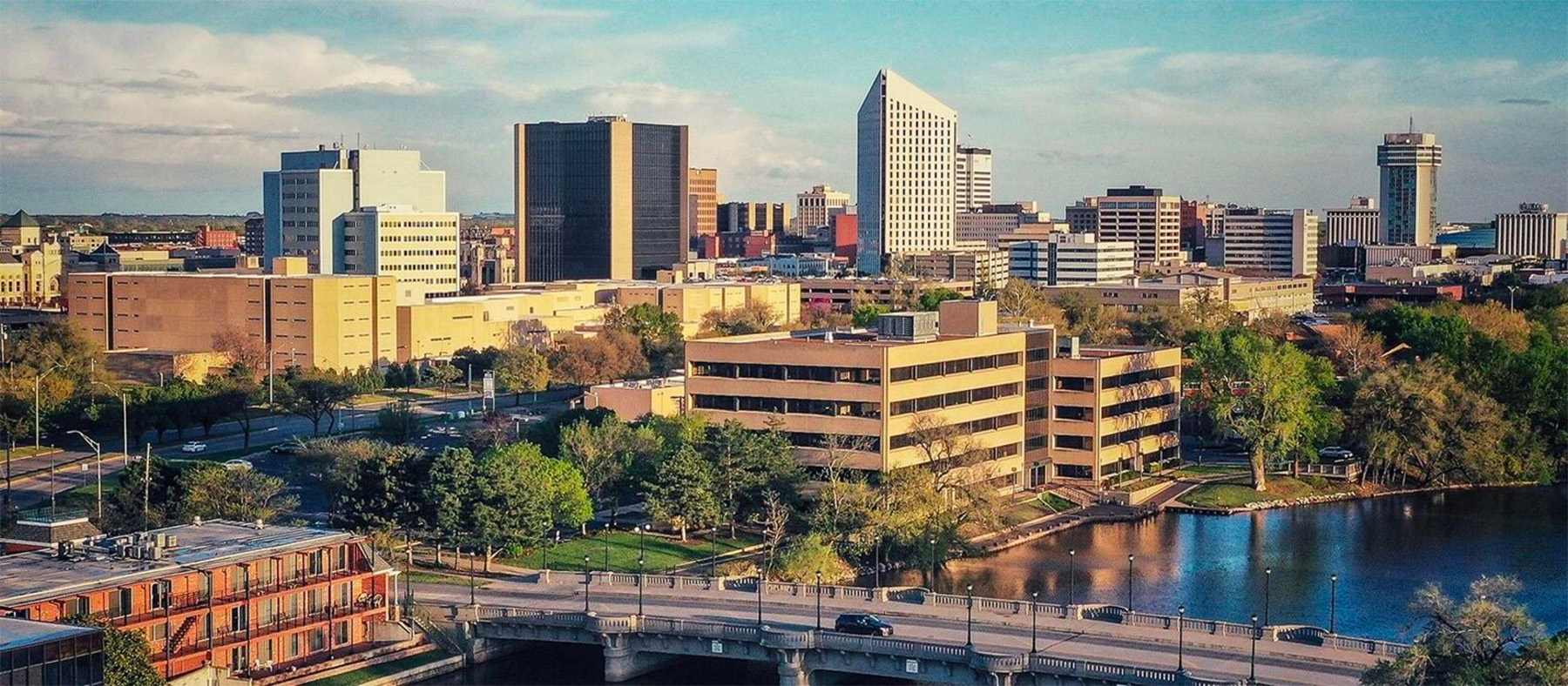

Kansas City, Kansas Wichita, Kansas

Wichita, Kansas Western, Kentucky

Western, Kentucky Kansas City, Missouri

Kansas City, Missouri Southeast, Missouri

Southeast, Missouri St. Louis, Missouri

St. Louis, Missouri Hudson Valley, New York

Hudson Valley, New York Raleigh, North Carolina

Raleigh, North Carolina Oklahoma City, Oklahoma

Oklahoma City, Oklahoma Nashville, Tennessee

Nashville, Tennessee Austin, Texas

Austin, Texas Dallas Fort Worth, Texas

Dallas Fort Worth, Texas Greater Houston, Texas

Greater Houston, Texas Houston, Texas

Houston, Texas San Antonio, Texas

San Antonio, Texas